Financial Crime and Fraud Management Solutions Market Opportunities and Forecast By 2029

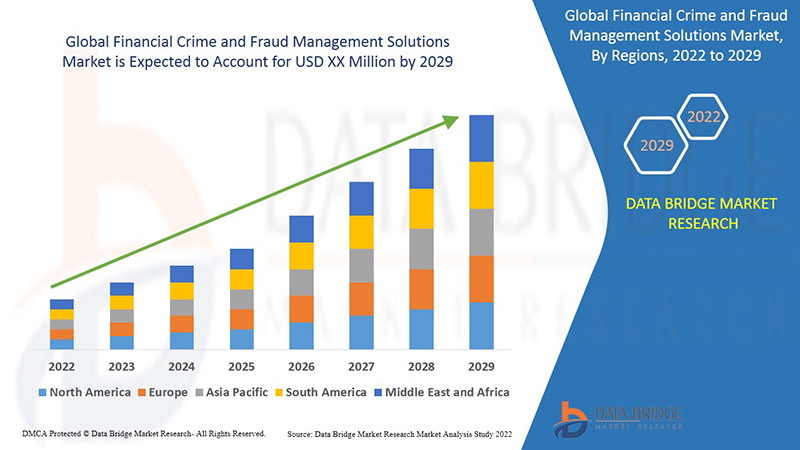

Data Bridge Market Research analyses that the financial crime and fraud management solutions market will exhibit a CAGR of 4.7% for the forecast period of 2022-2029.

Executive SummaryFinancial Crime and Fraud Management Solutions Market:

Data Bridge Market Research analyses that the financial crime and fraud management solutions market will exhibit a CAGR of 4.7% for the forecast period of 2022-2029.

Myriad of scopes are carefully evaluated through this Financial Crime and Fraud Management Solutions Marketreport which range from estimation of potential market for new product, identifying consumers reaction for particular product, figuring out general market tendencies, knowing the types of customers, recognizing dimension of marketing problem and more. The report encompasses key players along with their share (by volume) in key regions such as APAC, EMEA, and Americas and the challenges faced by them. The use of established statistical tools and coherent models for analysis and forecasting of market data makes this Financial Crime and Fraud Management Solutions Marketreport outshining.

Market drivers and market restraints estimated in this Financial Crime and Fraud Management Solutions Marketbusiness report gives understanding about how the product is getting utilized in the recent period and also gives estimations about the future usage. This report has a lot of features to offer about industry such as general market conditions, trends, inclinations, key players, opportunities, and geographical analysis. This market research report has been framed with the most excellent and superior tools of collecting, recording, estimating and analysing market data. The forecast, analysis and estimations that are carried out in this Financial Crime and Fraud Management Solutions Marketreport are all based upon the finest and well established tools and techniques such as SWOT analysis and Porters Five Forces analysis.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Financial Crime and Fraud Management Solutions Market report. Download Full Report:https://www.databridgemarketresearch.com/reports/global-financial-crime-and-fraud-management-solutions-market

Financial Crime and Fraud Management Solutions Market Overview

**Segments**

- By Component: Software, Services

- By Application: Anti-Money Laundering, Credit/Debit Card Fraud, Mobile Payment Fraud, Wire Transfer Fraud, Others

- By Deployment Mode: On-Premises, Cloud

- By Organization Size: Large Enterprises, Small and Medium-Sized Enterprises

- By Vertical: BFSI, Retail and Ecommerce, Healthcare, Government and Defense, IT and Telecom, Energy and Utilities, Others

The global financial crime and fraud management solutions market is segmented based on various factors to provide a comprehensive understanding of the industry landscape. The division by component includes software and services, with software being a key segment due to the technological advancements in fraud detection and prevention tools. The application segment covers areas such as anti-money laundering, credit/debit card fraud, mobile payment fraud, and wire transfer fraud, reflecting the diverse challenges faced by organizations in combating financial crimes. Deployment mode segments into on-premises and cloud-based solutions, catering to the varying security and scalability needs of businesses. Moreover, the market is categorized by organization size into large enterprises and small to medium-sized enterprises, recognizing the distinct requirements of different company scales. Lastly, the vertical segment highlights industries such as BFSI, retail and ecommerce, healthcare, government and defense, showcasing the widespread adoption of fraud management solutions across various sectors.

**Market Players**

- SAS Institute Inc.

- Oracle

- ACI Worldwide Inc.

- NICE Actimize

- FICO

- Fiserv, Inc.

- IBM Corporation

- SAP SE

- BAE Systems

- Software AG

- Experian Information Solutions, Inc.

- Bottomline Technologies (de)

- Dell EMC

- LexisNexis

- Feedzai

- First Data Corporation

Key market players play a crucial role in shaping the global financial crime and fraud management solutions market. Companies like SAS Institute Inc., Oracle, and ACI Worldwide Inc. are prominent in offering cutting-edge solutions to combat financial crimes through advanced analytics and artificial intelligence. NICE Actimize and FICO are known for their expertise in fraud detection and prevention, while Fiserv, Inc. and IBM Corporation provide comprehensive fraud management platforms catering to diverse industry verticals. SAP SE, BAE Systems, and Software AG are also significant players offering innovative fraud management solutions. The market also includes players like Experian Information Solutions, Inc., Bottomline Technologies, and LexisNexis, contributing to the competitive landscape with their robust offerings. Overall, these market players drive innovation and competitiveness in the financial crime and fraud management solutions market, meeting the evolving needs of organizations worldwide.

The global financial crime and fraud management solutions market continues to evolve due to factors such as increasing digitization, regulatory requirements, and the sophistication of fraudsters. One of the emerging trends in the market is the adoption of advanced technologies like machine learning and blockchain to enhance fraud detection capabilities. Machine learning algorithms can analyze vast amounts of data in real-time to identify anomalies and patterns indicative of fraudulent activities. Similarly, blockchain technology offers a secure and transparent way to record financial transactions, reducing the risk of fraud and improving traceability.

Another significant trend in the financial crime and fraud management solutions market is the shift towards cloud-based deployment models. Cloud solutions offer scalability, flexibility, and cost-effectiveness compared to traditional on-premises systems. Organizations are increasingly opting for cloud-based fraud management solutions to streamline operations, access real-time data insights, and ensure faster responses to potential threats. This trend is particularly relevant for small and medium-sized enterprises looking to leverage advanced fraud management tools without significant upfront investments.

Furthermore, the market is witnessing a rise in partnerships and collaborations among key players to enhance their product portfolios and expand their market reach. Strategic alliances enable companies to combine their expertise and resources to develop comprehensive fraud management solutions that address evolving threats and regulatory requirements. By joining forces, market players can leverage each other's strengths in areas such as data analytics, cybersecurity, and compliance to deliver more robust and integrated fraud management offerings to customers across various industries.

Moreover, there is a growing focus on regulatory compliance and data protection in the financial crime and fraud management solutions market. With stringent regulations governing data privacy and security, organizations are under pressure to implement robust fraud prevention measures to safeguard sensitive information and ensure compliance with industry standards. Market players are investing in technologies that provide advanced encryption, secure authentication, and continuous monitoring to mitigate the risk of data breaches and fraudulent activities.

In conclusion, the global financial crime and fraud management solutions market is witnessing rapid advancements driven by technological innovation, market consolidation, and increasing regulatory scrutiny. By adapting to emerging trends and collaborating with key industry players, organizations can strengthen their fraud detection capabilities, improve operational efficiencies, and mitigate financial risks effectively in an increasingly digital and interconnected financial landscape.The global financial crime and fraud management solutions market is a dynamic and rapidly evolving landscape driven by various factors such as digitization, regulatory requirements, and the continual advancement of fraudster tactics. One significant trend shaping the market is the increasing adoption of advanced technologies like machine learning and blockchain to enhance fraud detection capabilities. Machine learning algorithms enable real-time analysis of large datasets to identify fraudulent patterns, while blockchain technology offers secure and transparent transaction records, reducing the risk of fraud. This shift towards advanced technologies showcases the industry's commitment to staying ahead of increasingly sophisticated financial crimes.

Another key trend in the market is the transition towards cloud-based deployment models. Cloud solutions provide scalability, flexibility, and cost-effectiveness compared to traditional on-premises systems, making them an attractive choice for organizations looking to enhance their fraud management capabilities. The adoption of cloud-based solutions allows companies to access real-time data insights, streamline operations, and respond quickly to potential threats, particularly beneficial for small and medium-sized enterprises seeking advanced fraud management tools without significant upfront investments.

Moreover, partnerships and collaborations among market players are becoming more prevalent as companies strive to enhance their product offerings and expand their market presence. Strategic alliances enable firms to leverage each other's expertise and resources to develop comprehensive fraud management solutions that address emerging threats and regulatory requirements effectively. By pooling their strengths in areas such as data analytics, cybersecurity, and compliance, companies can deliver integrated fraud management solutions that cater to the evolving needs of customers across various industries.

Furthermore, regulatory compliance and data protection are top priorities in the financial crime and fraud management solutions market. With stringent regulations governing data privacy and security, organizations are under increasing pressure to implement robust fraud prevention measures to safeguard sensitive information and ensure compliance with industry standards. Market players are investing in technologies that offer advanced encryption, secure authentication, and continuous monitoring to mitigate the risk of data breaches and fraudulent activities, highlighting the industry's commitment to maintaining data integrity and protecting against financial crimes effectively.

In conclusion, the global financial crime and fraud management solutions market is undergoing significant transformations driven by technological innovation, strategic partnerships, and regulatory focus. By embracing emerging trends, leveraging advanced technologies, and prioritizing collaboration, organizations can enhance their fraud detection capabilities, improve operational efficiencies, and mitigate financial risks in an increasingly digital and interconnected financial ecosystem.

The Financial Crime and Fraud Management Solutions Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now:https://www.databridgemarketresearch.com/reports/global-financial-crime-and-fraud-management-solutions-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Core Objective of Financial Crime and Fraud Management Solutions Market:

Every firm in the Financial Crime and Fraud Management Solutions Market has objectives but this market research report focus on the crucial objectives, so you can analysis about competition, future market, new products, and informative data that can raise your sales volume exponentially.Size of the Financial Crime and Fraud Management Solutions Market and growth rate factors.

- Important changes in the future Financial Crime and Fraud Management Solutions Market.

- Top worldwide competitors of the Financial Crime and Fraud Management Solutions Market.

- Scope and product outlook of Financial Crime and Fraud Management Solutions Market.

- Developing regions with potential growth in the future.

- Tough Challenges and risk faced in Financial Crime and Fraud Management Solutions Market.

Global Financial Crime and Fraud Management Solutions Market top manufacturers profile and sales statistics.

Browse More Reports:

North America Warehouse Management System Market

Global Weather Forecasting Services Market

Global Methylmalonic Acidemia Market

Global Potato Protein Market

Asia-Pacific Clinical Trial Imaging Market

Europe Lubricating Oil Additives Market

Global Portable Toilet Rental Market

Asia-Pacific Footwear Sole Materials Market

Global Dehydrated Onion Market

Global Consignment Software Market

Middle East and Africa Antimicrobial Coatings Market

Europe Dental Infection Control Market

Europe Radiofrequency (RF) Microneedling Market

Global Hepatitis Test Solution/Diagnosis Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:-corporatesales@databridgemarketresearch.com